5 Things you need to arrange Whenever Making an application for financing On the internet

Getting financing are a financially sound answer to power your cash. It is a functional source of financing for a corporate or money as well as an excellent supply of money to spend on your future. You’ll find quite a lot of banks and you may credit institution you to render funds; a lot of them try actually available on the net. Within point in time, entry to the latest loans is literally at hand. not, prior to beginning the application, definitely have these materials easily accessible for a flaccid cruising app process.

step one. Valid ID

First of all you need whenever trying to get good financing is actually a valid ID. This helps the bank pick anyone in order to who he could be planning to provide their cash. Bringing an enthusiastic ID needs into lender to perform history inspections with the every their individuals.

To possess CIMB Lender, you can also only need one good ID, but consider very first if your ID card you’ve got easily accessible is amongst the after the:

- Driver’s license

- Passport

- Elite Regulation Payment (PRC) ID

- Personal Safety measures (SSS) ID

- Unified Multi-purpose ID (UMID)

- Postal ID

- COMELEC Voter’s ID Credit

dos. Proof of Earnings

One of the most very important parts of your loan software is money verification. This is done to ensure that the bank so as to assess your allowance in addition to dangers that may been when financing currency for your requirements.

Whenever obtaining an excellent CIMB Personal loan, there are a few data files requisite out-of people and these all depends with the whether you are operating or notice-employed.

- Current 1 month pay sneak

- Certification of A job

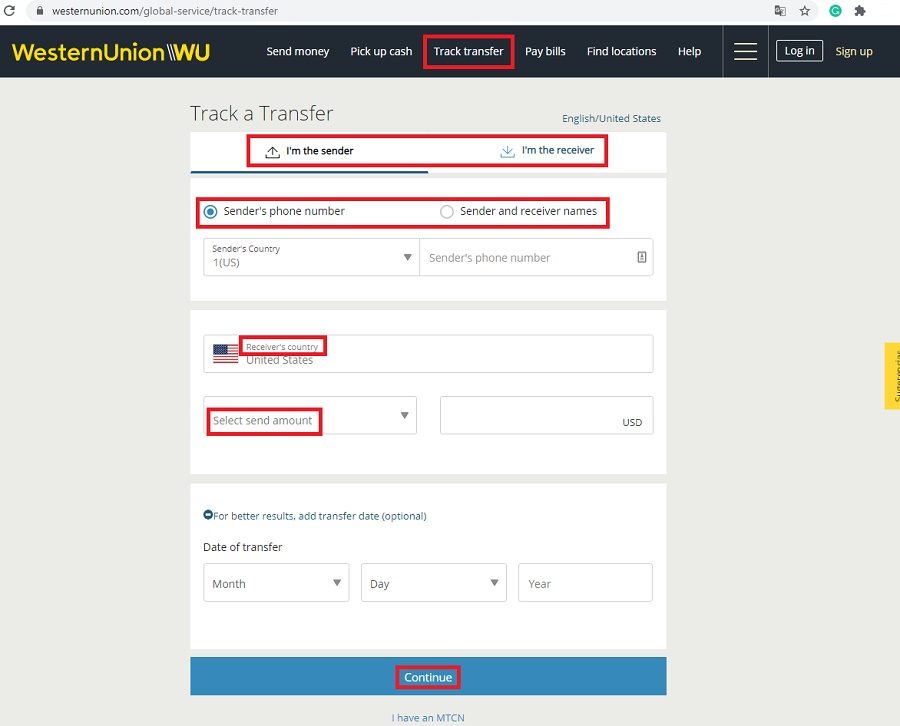

step 3. A steady internet connection

A great web connection is vital whenever making an application for a loan on line. This is certainly to aid avoid one too many waits that cause mistakes in uploading your preferences. Be sure that you have a reliable connection to the internet before you could start your loan app processes.

4. A beneficial lights

Now that you can apply for a loan digitally, some programs for instance the CIMB Lender PH app, might need you to definitely guarantee the identity because of an effective selfie consider. Having an effective lights makes it much simpler on the system [MOU1] to determine the facial features and you can make sure they on the ID you registered. Discover an area that’s close a windows otherwise a-room with plenty of white when planning on taking a definite photos.

Additionally, bringing a photo and you can publishing your revenue records from inside the a properly-illuminated city assurances that you could take clear pictures and you may messages of all of the needed details the financial institution needs when confirming the income source.

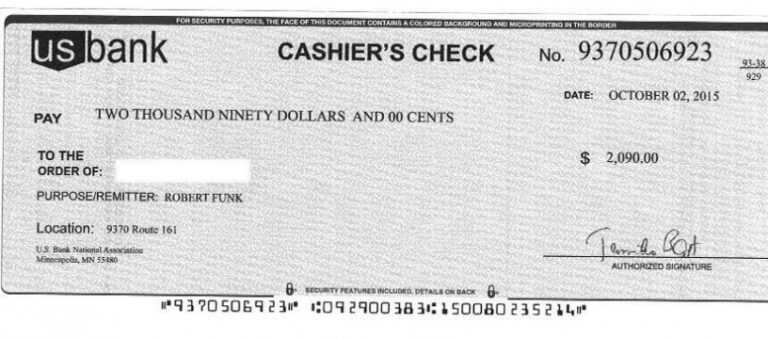

5. An excellent disbursement account

Lastly, make certain you possess a bank checking account ready for which you will be able to receive the disbursement of your borrowed count. Keep in mind that particular banks may charge to have disbursement costs that vary based on and this lender otherwise borrowing studio your choose incorporate that loan out of.

Having a CIMB Personal bank loan, a beneficial disbursement fee of just one% of the dominant loan amount or PHP five hundred (any try high) will get incorporate if you decide to disburse the loan for other banking institutions.

However, if you disburse the loan to the CIMB Lender family savings, you would not become never be energized people disbursement fee.

If you are an existing CIMB Checking account holder, your . An initial-of-its-type program where you could enjoy annual increasing rebates starting with 10% on the first 12 months or more in order to 30% by the fifth year. Everything you need to create is shell out the month-to-month loan costs constantly and on go out!

Merely pertain and have recognized to possess an unsecured loan for the or prior to in order to become qualified. Make a move towards your financial specifications!